How Much Is Inheritance Tax In Ca 2024

How Much Is Inheritance Tax In Ca 2024. Unlike the federal gift tax which focuses on lifetime transfers, the california inheritance tax primarily targets beneficiaries who receive property through an estate. In 2024, the threshold for the federal estate tax is presently $13,610,000 for individuals, $27,220,000 for married couples, plain and simple.

In california, there is no state inheritance tax, so you can inherit any amount of money or cash without owing state taxes on it. In 2024, the lifetime gift and estate tax exemption for individuals is $13.61 million.

In 2024, The Threshold For The Federal Estate Tax Is Presently $13,610,000 For Individuals, $27,220,000 For Married Couples, Plain And Simple.

Free estate tax calculator to estimate federal estate tax in the u.s.

Inheritance Tax Targets The Beneficiaries Who Receive Assets From A Deceased Person, While Estate Tax Focuses On The Total Value Of The.

Since california is not a state that imposes an inheritance tax, the inheritance tax in 2024 is 0% (zero).

How Much Is Inheritance Tax In Ca 2024 Images References :

Source: vanessawflory.pages.dev

Source: vanessawflory.pages.dev

2024 California State Tax Brackets Dorey, Over 20,000 become cas, shivam mishra is air 1; If the value of the assets being transferred is higher than the federal estate tax exemption (which is $13.61 million for tax year 2024 and $12.92 million for tax year.

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, The good news for beneficiaries in 2024 is that the tax implications are generally favorable. In 2024, the lifetime gift and estate tax exemption for individuals is $13.61 million.

Source: federicawhester.pages.dev

Source: federicawhester.pages.dev

What Is California Tax Rate 2024 Josee Malissa, This was increased from the 2023. Icai ca may 2024 inter, final results out:

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-c5902af4dd0e49918533982c240cf419.jpg) Source: www.investopedia.com

Source: www.investopedia.com

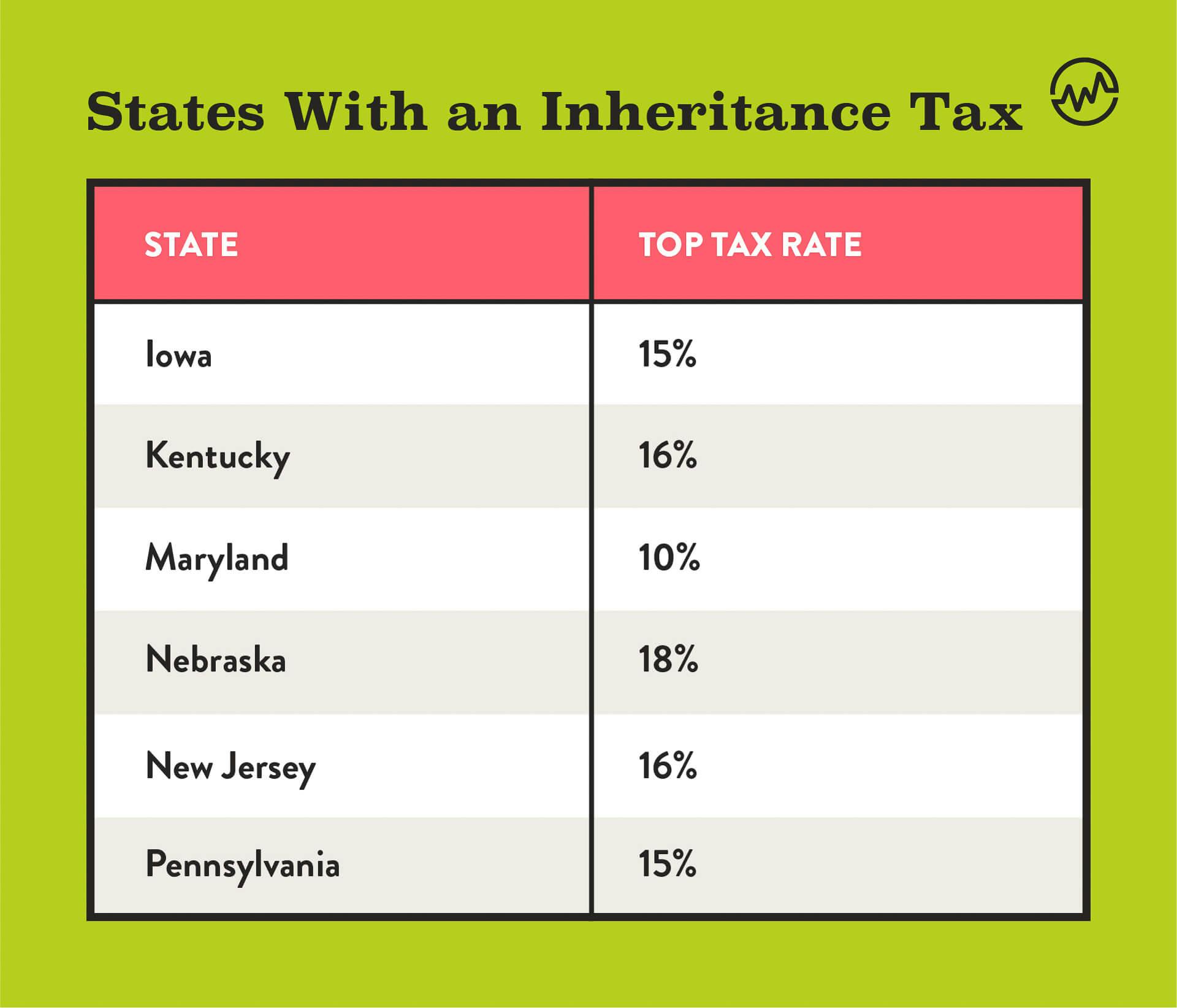

Inheritance Tax What It Is, How It's Calculated, and Who Pays It, This is up from $12.92 million in 2023. What is the inheritance tax in california?

Source: wealthfit.com

Source: wealthfit.com

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, California residents don’t need to worry about a state inheritance or estate tax as it’s 0%. The good news for beneficiaries in 2024 is that the tax implications are generally favorable.

Source: milkaqmodestine.pages.dev

Source: milkaqmodestine.pages.dev

Taxes En California 2024 Albina Tiffie, In 2024, the threshold for the federal estate tax is presently $13,610,000 for individuals, $27,220,000 for married couples, plain and simple. California residents don’t need to worry about a state inheritance or estate tax as it’s 0%.

Source: monahrafaelia.pages.dev

Source: monahrafaelia.pages.dev

Capital Gains Tax Rate 2024 Donia Jasmine, If the value of the assets being transferred is higher than the federal estate tax exemption (which is $13.61 million for tax year 2024 and $12.92 million for tax year. Under the new tax regime, taxpayers with a net taxable income of up to rs 7,00,000 are eligible for a.

Source: www.californiatrustestateandprobatelitigation.com

Source: www.californiatrustestateandprobatelitigation.com

Is Inheritance Taxable in California? California Trust, Estate, What this means is that for individuals with estates worth $13.61. Receiving an inheritance often prompts questions about tax liabilities.

Source: wealthfit.com

Source: wealthfit.com

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, The federal estate tax goes into effect for estates valued at $13.61 million and up in 2024. Federal tax rates range between 18% and 40%, depending on the amount above the $12.92 million threshold, or exemption amount, per person in 2023 or $13.61.

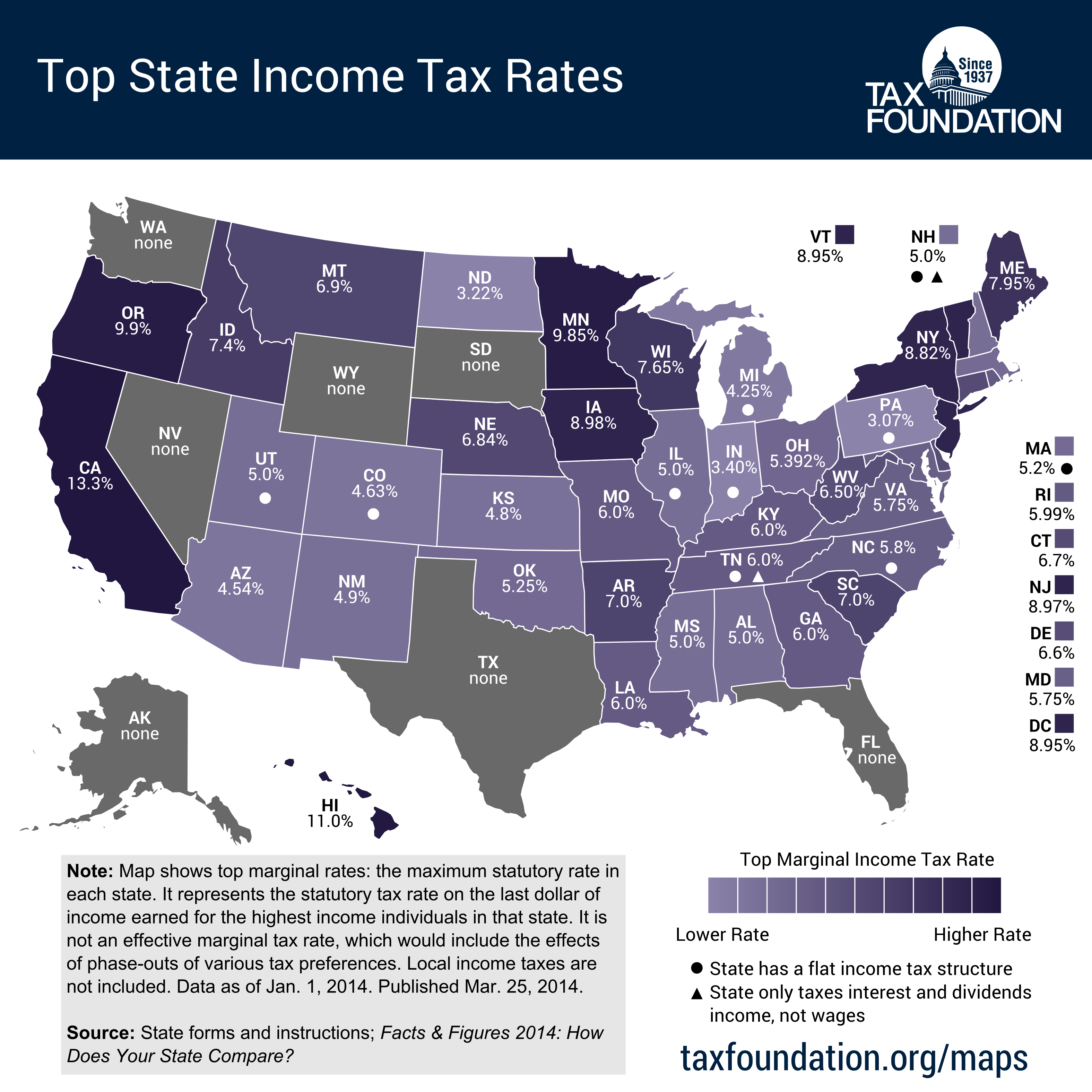

Source: taxfoundation.org

Source: taxfoundation.org

Does Your State Have an Estate or Inheritance Tax?, Over 20,000 become cas, shivam mishra is air 1; Alison parry, head of will and trust disputes at jmw solicitors, says a mirror will is where two parties (often a couple, whether married or not) leave their estates in a.

This Was Increased From The 2023.

No inheritance tax in california for 2024.

Federal Tax Rates Range Between 18% And 40%, Depending On The Amount Above The $12.92 Million Threshold, Or Exemption Amount, Per Person In 2023 Or $13.61.

Icai ca may 2024 inter, final results out: