Reimburse Mileage Rate 2024

Reimburse Mileage Rate 2024. Especially if they regularly drive. Having employees use their own vehicle for work can be expensive.

5p per passenger per business mile for. What is the federal mileage reimbursement rate for 2024?

The Irs Mileage Rate 2024 Is Key Information For All Drivers Who Use Their Vehicles For Business Purposes.

Approved mileage rates from tax year 2011 to 2012 to present date.

Having Employees Use Their Own Vehicle For Work Can Be Expensive.

What is the current mileage reimbursement rate for 2024?

Reimburse Mileage Rate 2024 Images References :

Source: hannisqsharlene.pages.dev

Source: hannisqsharlene.pages.dev

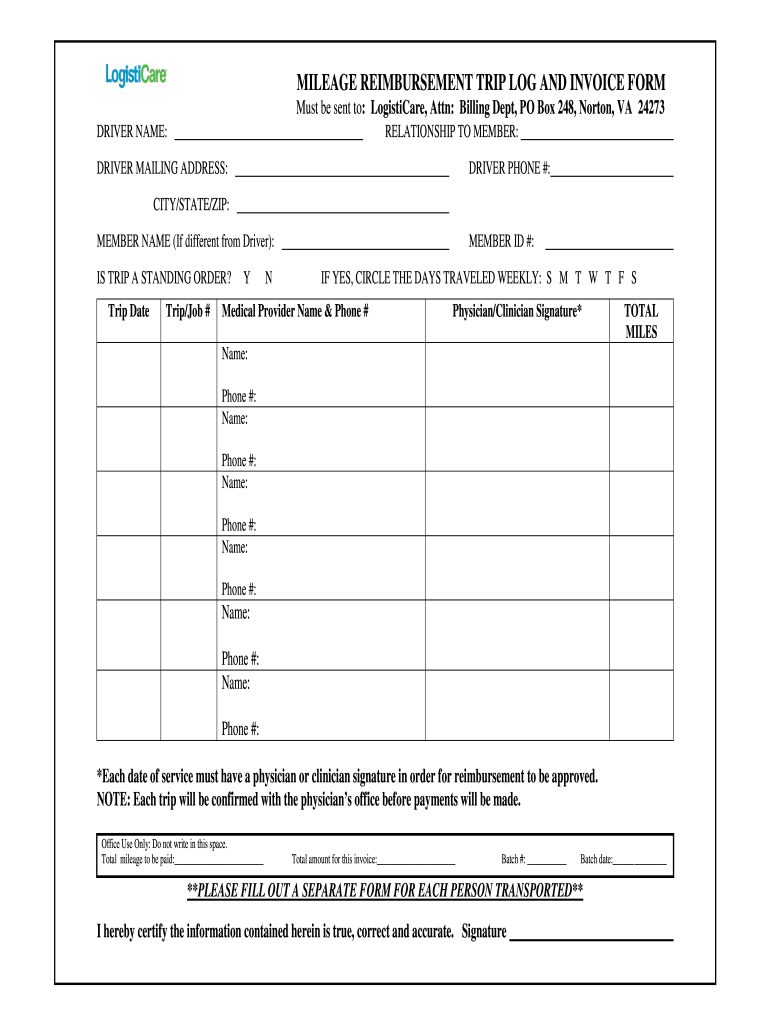

What Is The 2024 Irs Mileage Reimbursement Rate Connie Constance, When your employees abroad have to travel for work purposes, they will expect to be reimbursed for expenses. Approved mileage rates from tax year 2011 to 2012 to present date.

Source: hannisqsharlene.pages.dev

Source: hannisqsharlene.pages.dev

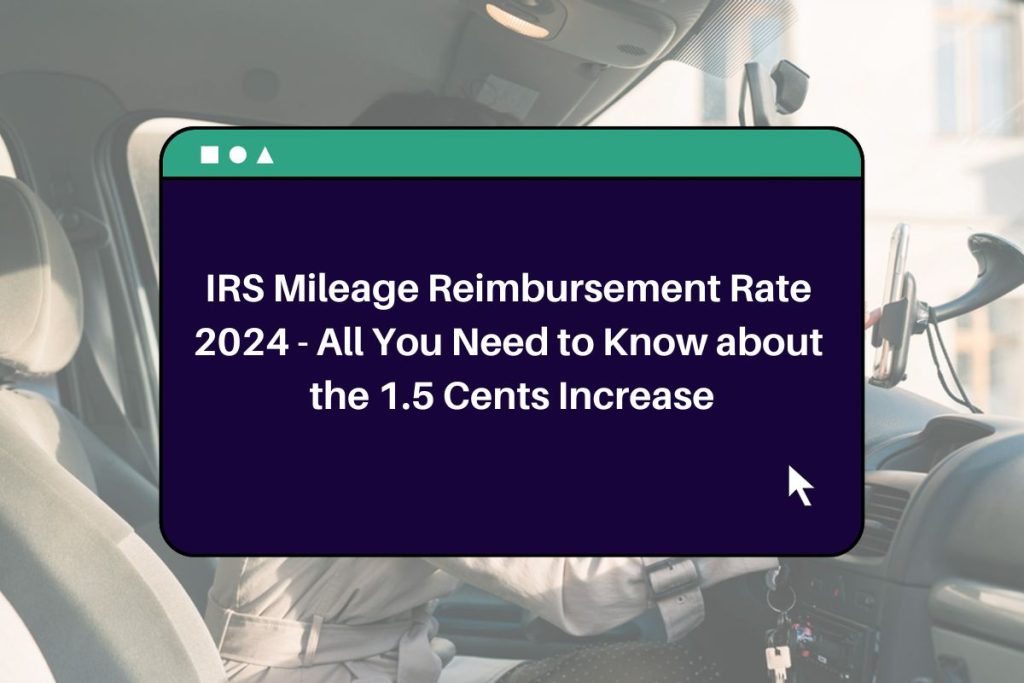

What Is The 2024 Irs Mileage Reimbursement Rate Connie Constance, these figures are pivotal for. The irs is raising the standard mileage rate by 1.5 cents per mile for 2024.

Source: leoraqamalita.pages.dev

Source: leoraqamalita.pages.dev

Mileage Rate 2024 Reimbursement Aline Beitris, Each country will have some rules and. 17 rows page last reviewed or updated:

Source: ashlenqmaryrose.pages.dev

Source: ashlenqmaryrose.pages.dev

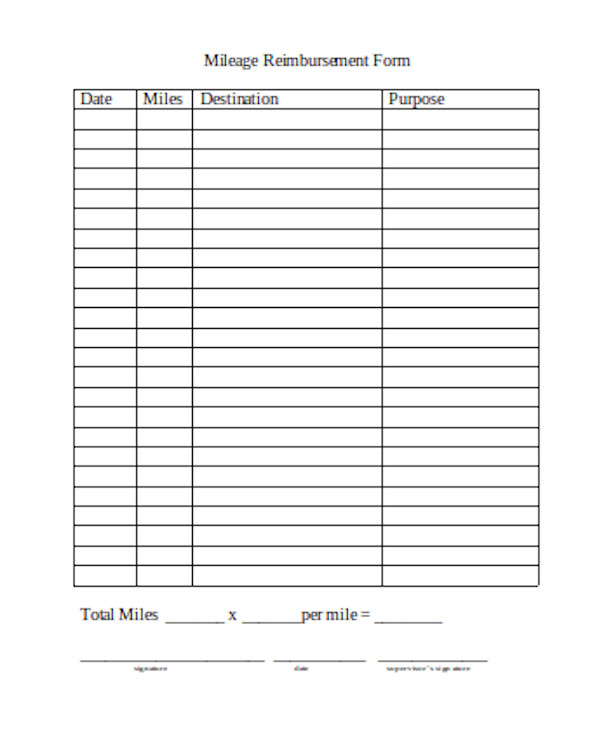

Typical Mileage Reimbursement 2024 channa chelsey, When your employees abroad have to travel for work purposes, they will expect to be reimbursed for expenses. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

Source: www.driversnote.ca

Source: www.driversnote.ca

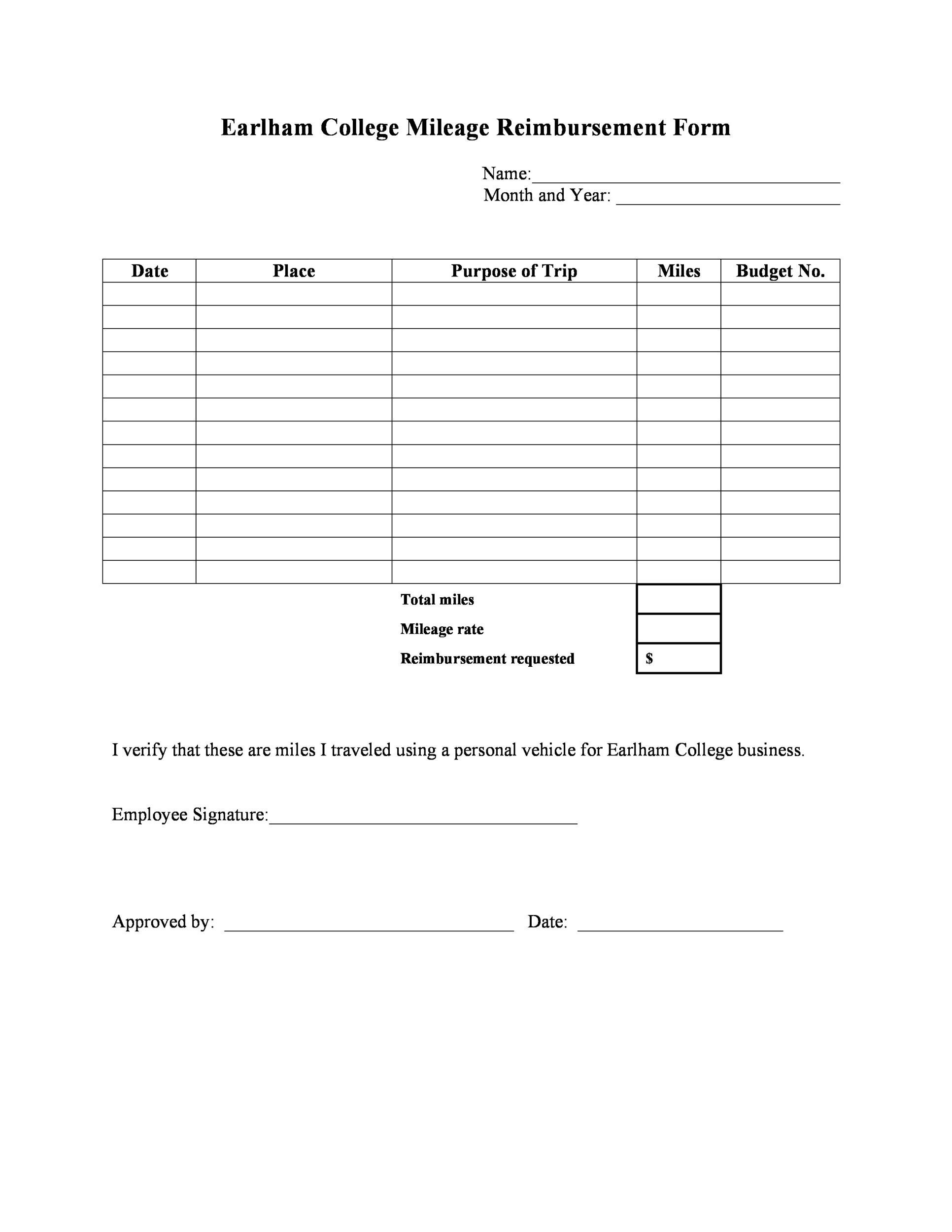

Mileage Log Template 2024, Free Excel and PDF Log Book Driversnote, Effective january 1, 2024, the mileage reimbursement rate will increase from 65.5 cents per mile to 67 cents per mile for all business miles driven from. The irs mileage rate 2024 is key information for all drivers who use their vehicles for business purposes.

Source: matricbseb.com

Source: matricbseb.com

IRS Mileage Reimbursement Rate 2024 All You Need to Know about the 1., 67 cents per mile for business purposes. From 1 june 2024, the advisory electric rate for fully electric cars will be 8 pence per mile.

Source: www.dochub.com

Source: www.dochub.com

Mileage reimbursement trip Fill out & sign online DocHub, Each country will have some rules and. Fl mileage reimbursement rate 2024.

Source: stefaniewsusi.pages.dev

Source: stefaniewsusi.pages.dev

Wa State Mileage Reimbursement 2024 Mandy Rozelle, Hybrid cars are treated as either petrol or diesel cars for advisory fuel. What is the current mileage reimbursement rate for 2024?

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

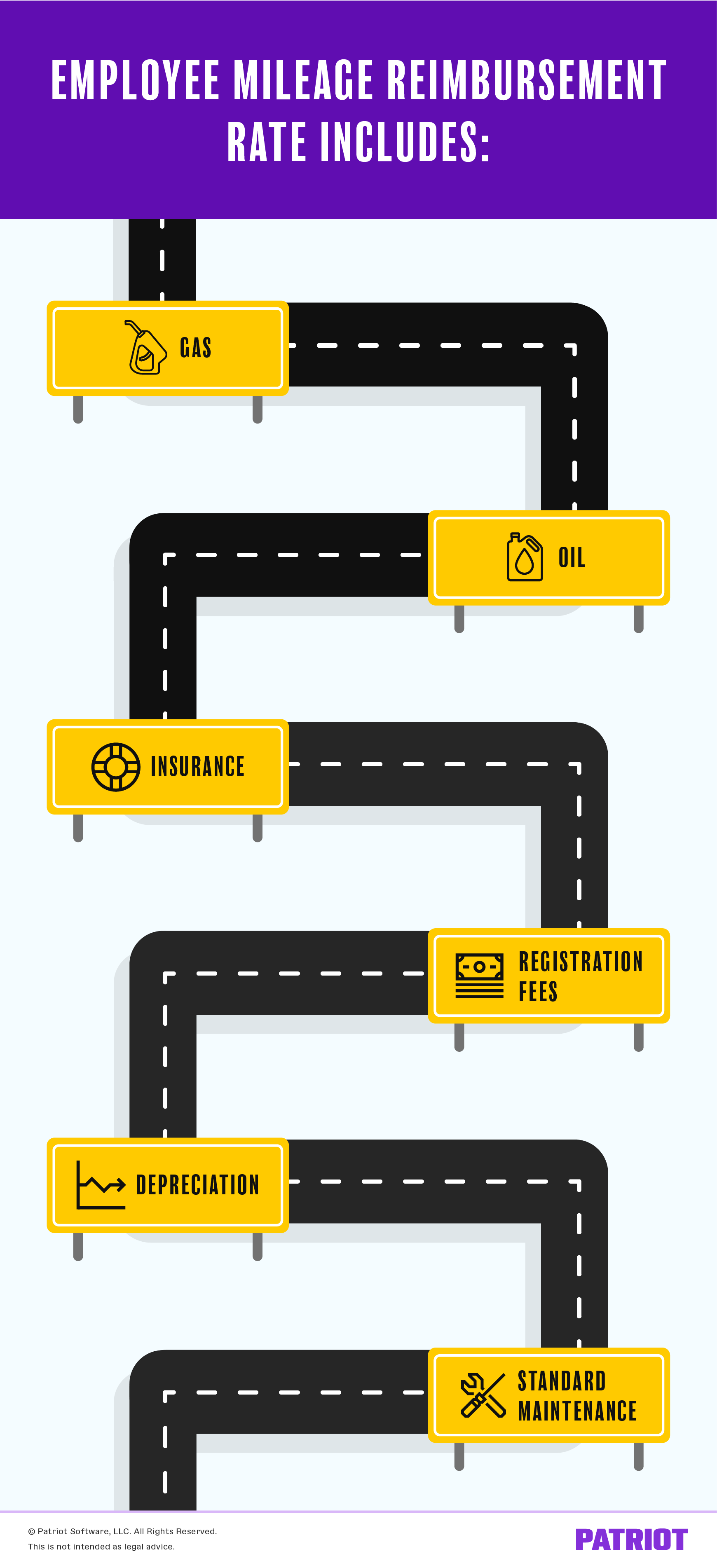

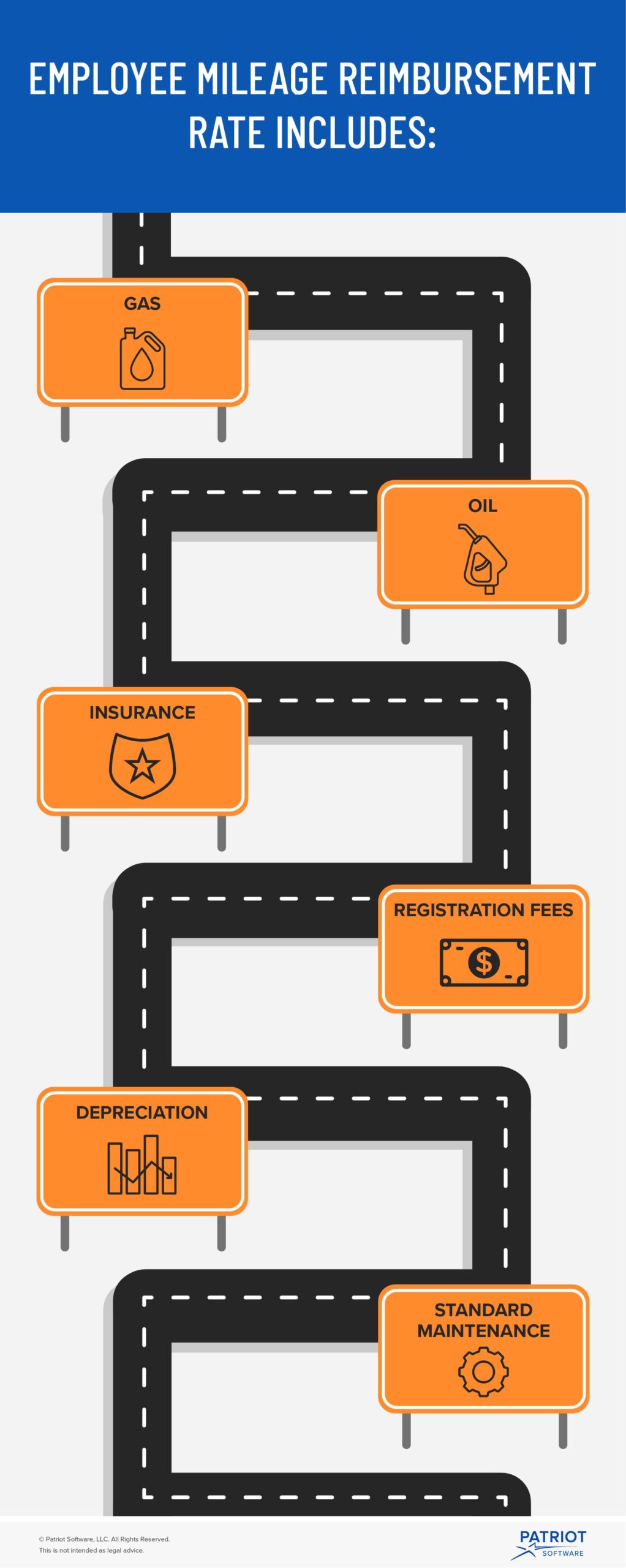

What is Mileage Reimbursement? 2024 Mileage Reimbursement, As of 2024, the guidelines are as follows: The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Mileage Reimbursement Advantages, Laws, & More, Washington — the internal revenue service. The standard mileage rate for 2024 is currently 67 cents per mile, which is up from 65.5 cents per mile in 2023.

The 2024 Irs Standard Mileage Rates Are 67 Cents Per Mile For Every Business Mile Driven, 14 Cents Per Mile For Charity And 21 Cents Per Mile For Moving Or Medical.

The irs mileage rate 2024 is key information for all drivers who use their vehicles for business purposes.

You Can Use This Mileage Reimbursement Calculator To Determine The Deductible Costs Associated With Running A Vehicle For Medical, Charitable, Business, Or Moving.

The irs has set the company mileage reimbursement rate for 2024 at 67 cents per mile.

Category: 2024